Gift Tax 2024 Exclusion From Income Tax

Gift Tax 2024 Exclusion From Income Tax. 11 rows — — the income tax act states that gifts whose value exceeds. Under federal tax law, gross income includes all income from whatever source derived unless it is specifically excluded from gross income by law.

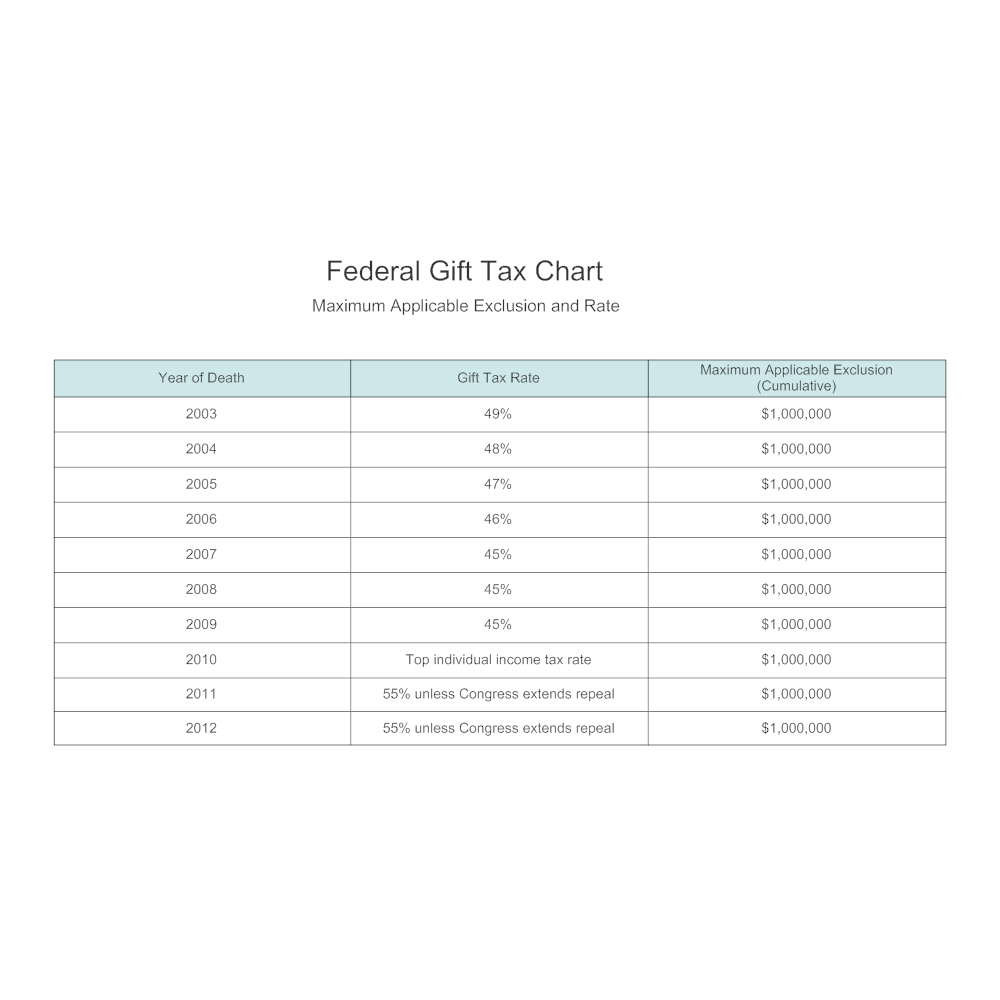

— annual federal gift tax exclusion. When calculating gift tax, you will need to know the gift value that exceeded the annual exclusion limit to determine the corresponding rate which ranges from.

Gift Tax 2024 Exclusion From Income Tax Images References :

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, Being an “influencer” is big business.

Source: haliejessamine.pages.dev

Source: haliejessamine.pages.dev

Annual Gift Tax Exclusion 2024 Per Person Kelli Melissa, — this growing form of marketing can result in taxable income to individuals.

Source: kattibleonanie.pages.dev

Source: kattibleonanie.pages.dev

Annual Gift Tax Exclusion 2024 Amount Chart Danya Ellette, Under federal tax law, gross income includes all income from whatever source derived unless it is specifically excluded from gross income by law.

Source: irsfreshstart.com

Source: irsfreshstart.com

2024 Gift Tax Exclusion What You Need to Know, You can use the gift tax exclusion to give away a set amount every year, $18,000 in 2024 ($17,000 in 2023;

Source: jeanettewcarri.pages.dev

Source: jeanettewcarri.pages.dev

Annual Gift Tax Exclusion 2024 Becca Carmela, Being an “influencer” is big business.

Source: cissyyrobinetta.pages.dev

Source: cissyyrobinetta.pages.dev

Lifetime Gift Tax Exclusion 2024 Vera Allison, Double if married), to as many people as you wish.

Source: zondaqjulita.pages.dev

Source: zondaqjulita.pages.dev

What Is The Annual Exclusion For Gifts In 2024 Ivory Letitia, The annual gift tax exclusion limit is typically adjusted annually to account for inflation.

Source: kattibleonanie.pages.dev

Source: kattibleonanie.pages.dev

Annual Gift Tax Exclusion 2024 Amount Chart Danya Ellette, In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: oliawilmette.pages.dev

Source: oliawilmette.pages.dev

2024 Gift Tax Exclusion Amount Elana Harmony, Since 2021, the annual exclusion.

Source: constantinewaggie.pages.dev

Source: constantinewaggie.pages.dev

Gift Tax Exclusion 2024 Irs Roxie Clarette, — if the giver provides a gift over $18,000 in 2024, they must file a gift tax return (irs form 709) with their federal income tax return to account for gifts and track the lifetime.

Category: 2024