Tax Extension Business 2024

Tax Extension Business 2024. How to request a tax extension in 2024. In 2024, you must file quarterly taxes on the following dates:

Feb 1, 2024, 10:09 am pst. As of march 29, 90 million households had already filed their.

You Might Think About Buying Some Extra Time With An.

Irs customer service this tax day 2024, the irs is working on developing and.

To Successfully File A Business Tax Extension In 2024, It’s Crucial To Understand The Important Dates And Deadlines Associated With The Extension Process.

Feb 1, 2024, 10:09 am pst.

Do You Need More Time To File Your 2023 Business Tax Return?

Images References :

Source: www.fool.com

Source: www.fool.com

How to File a Business Tax Extension in 2024, Instead of filing by april 15, a tax extension moves your small business tax return due date six months into the future. Key tax deadlines are coming up in 2024 for llc and corporation businesses.

Source: www.zenledger.io

Source: www.zenledger.io

How to File a Tax Extension? ZenLedger, In 2024, you must file quarterly taxes on the following dates: An extension gives you until october 16, 2023, to file.

Source: www.marca.com

Source: www.marca.com

IRS Form 4868 How to get a tax extension in 2022? Marca, Make sure to apply for your tax extension by the regular tax deadline, which is april 15, 2024. Most businesses use form 7004 to file for an extension, but.

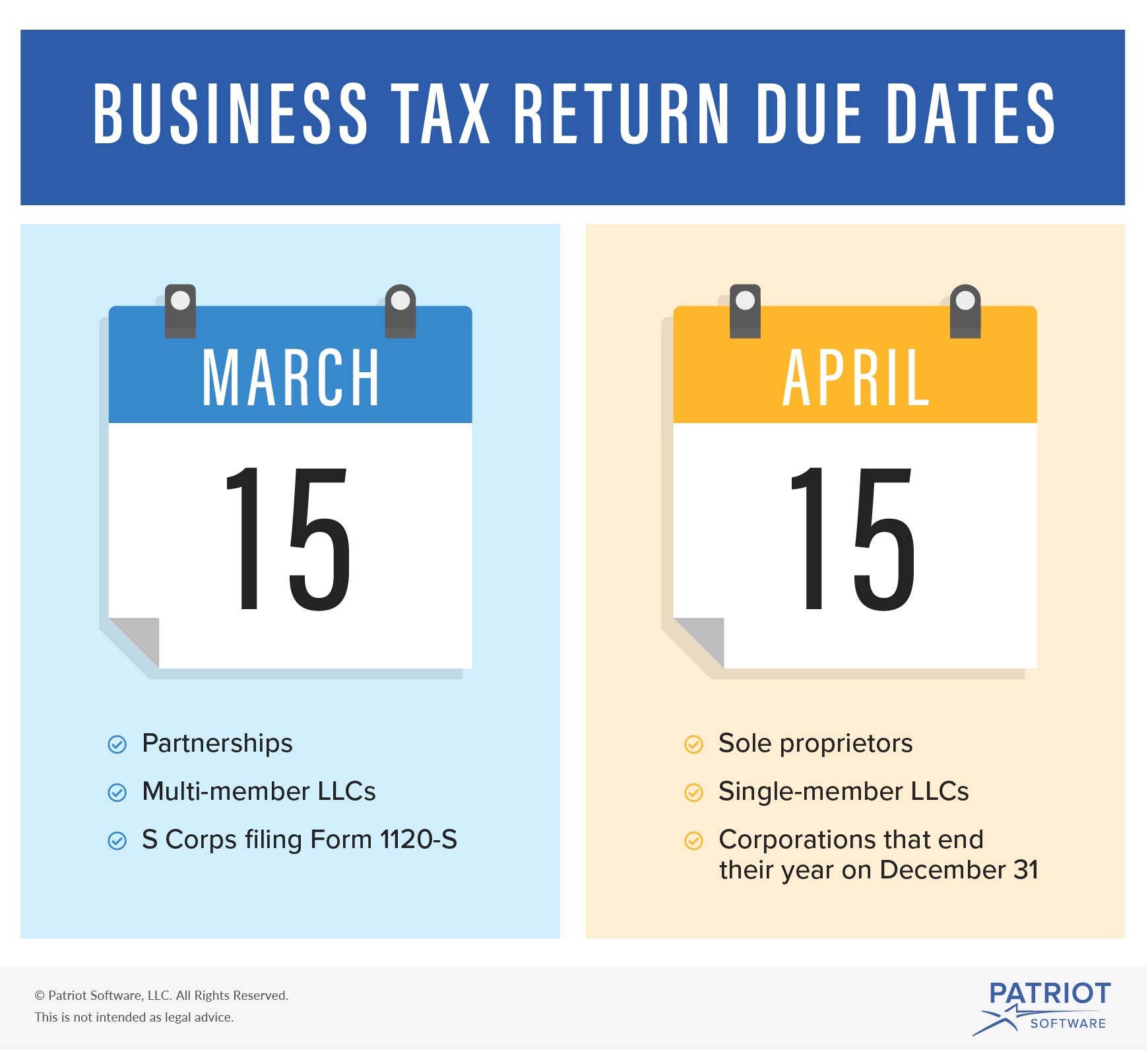

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Business Tax Return Due Date by Company Structure, For the 2024 tax year, estimated tax payments for businesses operating on a calendar year are due on the following days: To successfully file a business tax extension in 2024, it’s crucial to understand the important dates and deadlines associated with the extension process.

Source: blog.extensiontax.com

Source: blog.extensiontax.com

March 15, 2022, is the deadline to apply for tax extensions for your, According to irs data, over 19 million individuals sought an. T ax deadlines are crucial to keep in mind to avoid penalties and stay compliant with the irs.

Source: www.businessnewsdaily.com

Source: www.businessnewsdaily.com

What to Know About Filing a Business Tax Extension, For the 2024 tax year, estimated tax payments for businesses operating on a calendar year are due on the following days: An extension gives you until october 16, 2023, to file.

![Small Business Tax Filing Extension [2023]](https://www.gokapital.com/wp-content/uploads/2023/03/the-word-taxes-through-the-glasses-of-a-person-fil-2023-01-27-04-57-11-utc-scaled.jpg) Source: www.gokapital.com

Source: www.gokapital.com

Small Business Tax Filing Extension [2023], Tax time can be a scramble, but what if you’re in the eleventh hour and your ducks aren’t quite in a row? File form 4868, application for automatic extension of time to file u.s.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Business Tax Extension A Strategic Approach to Financial, How to get an extension of time to file your tax return. For the 2024 tax year, estimated tax payments for businesses operating on a calendar year are due on the following days:

Source: blog.extensiontax.com

Source: blog.extensiontax.com

Extension Tax Blog Federal Tax Extension of Time to file business and, Tax time can be a scramble, but what if you’re in the eleventh hour and your ducks aren’t quite in a row? File your return by april 15 even if you can’t pay.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Free Irs Tax Extension 2024 Shirl Marielle, Irs customer service this tax day 2024, the irs is working on developing and. Most businesses use form 7004 to file for an extension, but.

April 15, 2024 Individual And Business Tax Returns Are Due.

Do you need more time to file your 2023 business tax return?

You Might Think About Buying Some Extra Time With An.

After you’ve submitted your extension application, your new deadline.